Disclosures about directors’ skills and expertise are increasingly coming under the microscope as investors ramp up calls to link board members’ skills with company needs and strategy and activists use the universal proxy to seize upon alleged deficiencies in boardroom competence. Now, new research could add fuel to the fire. A recent study suggests that… Continue reading Are Check Marks ‘Cheap Talk’ in Board Skills Matrices?

Tag: Board of Directors

Boards Named Slew of First-Time Directors This Fall

Large companies have seen significant board turnover in the past several months, capping off a year of increased focus from stakeholders on individual directors’ skill sets and board refreshment. Companies also appointed a large number of directors with government connections. Some 80% of S&P 500 directors currently say they have government and/or regulatory relations experience,… Continue reading Boards Named Slew of First-Time Directors This Fall

Cyber Expertise Needs Vetting as Boards Seek Crucial Skill

In recent years, search firms have been flooded by requests for director candidates with cybersecurity backgrounds as boards seek to leverage this expertise when responding to rising cyber risks. …Over the past five years, companies in both the Russell 3000 and S&P 500 have seen the number of directors boasting cybersecurity expertise climb by the… Continue reading Cyber Expertise Needs Vetting as Boards Seek Crucial Skill

Boards Continue Size Expansions to Bring in New Directors

Roughly a dozen S&P 500 companies expanded the size of their boards during the past three months in order to recruit new directors at companies including Danaher, General Mills, Medtronic and Discover Financial Services. The data comes from public company intelligence provider MyLogIQ. The expansion continues a trend of the past few years in which… Continue reading Boards Continue Size Expansions to Bring in New Directors

Board Leaders See Pay Hikes

Directors are approving pay raises for board leaders as investor scrutiny intensifies and as competition for new board members and leadership talent grows fiercer. Dozens of Russell 1000 companies opted to increase premiums paid to non-executive board chairs and lead directors in the past year, some even doubling retainers, according to pay data from public… Continue reading Board Leaders See Pay Hikes

Precision Raises for Directors as Comp Freeze Thaws

Boards have begun making small adjustments to director compensation programs, bringing cash and equity retainers up to market medians and making precision increases to committee and board leadership retainers after two years of leaving pay untouched. A look at 2022 proxy statements filed so far among Russell 1000 companies using public company intelligence provider MyLogIQ… Continue reading Precision Raises for Directors as Comp Freeze Thaws

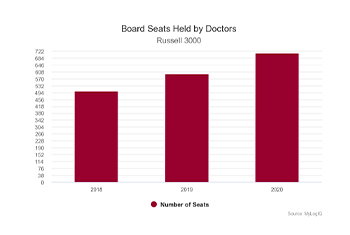

What’s Up, Doc? The Number of M.D.s on Boards

The number of physicians on boards shot up in 2020. Some recruiters say this is part of a trend that has been on the rise for the past decade or longer, while others link the jump to the pandemic.

In 2020, there were 578 medical doctors on Russell 3000 boards, up from 484 in 2019 and 438 the year prior, according to data from public company intelligence provider MyLogIQ. Some of those individuals serve on multiple boards, bringing the total number of board positions filled by doctors to 502, 596 and 711 for the past three years, respectively.

“We have seen explosive growth in the number of health care sector companies in the Russell 3000 Index, so it makes sense that we are seeing more director positions occupied by medical doctors,” says Ganesh Rajappan, CEO and founder of MyLogIQ. “It’s too early to determine if Covid is driving a new wave of physician directors. We will have to wait for next year’s reported data to see if there is an uptick.”

Boards Look to Directors With Reputational Risk Experience

As companies seek to gird their reputations, boards are looking for new directors with deep corporate affairs backgrounds to help them oversee and safeguard an intangible asset that can swiftly erode.

A short list of corporate affairs experts who have ascended to boardrooms in recent years includes Dee Dee Myers, the former Clinton administration White House press secretary who went to Wynn Resorts; AnnaMaria DeSalva, the chairman and CEO of public relations firm Hill+Knowlton Strategies, who serves on the board of XPO Logistics; and Beatriz Perez, Coca-Cola’s chief communications and chief sustainability officer, who joined the board of W.W. Grainger. In fact, at least a dozen S&P 500 companies and New York Stock Exchange-traded companies show director biographies with current or retired corporate affairs experience. That’s according to public company intelligence provider MyLogIQ and SEC filings.